Medical billing in BC tends to be a bit overwhelming. It’s often difficult not only to get started but to keep up with payment schedules, reports and deadlines. This chapter walks you through the fundamentals of how physician billing in BC works.

1. Canadian Payment Models

There are 3 major payment models for Canadian doctors. It’s important to understand how each payment model works so that you can negotiate your contract accordingly and make sure you’re getting compensated properly for the work that you do.

Below are the 3 most common compensation models, and the pros and cons of each.

Salary

Getting a salary means you’ll get a fixed amount of money each time you’re paid. Salaries can be hourly rates, shift stipends or sessional payments. In BC it’s very uncommon that you’d be working under a fixed salary. Salaries are generally more popular in academic institutions.

If you do accept a position with a salary, then your contract will outline your minimum expectations and typically a maximum limit of payment.

Pros: It’s simple and it’s nice to know how much you’re going to get each pay period.

Cons: There’s no incentives or encouragement to bring on new patients. You’ll miss out on business income and tax deductions.

Fee-for-Service

In a traditional fee-for-service (FFS) model, you are self-employed and operate as a small business. You submit ‘invoices’ (known as claims) of who you saw and what you did to the Medical Services Plan (MSP) in BC.

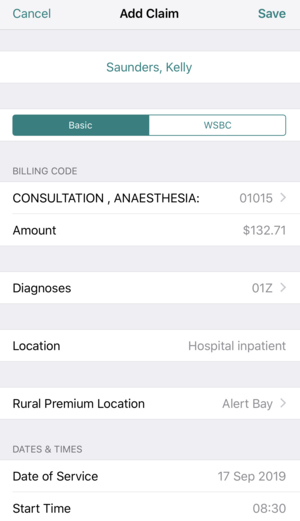

FFS is the most common payment plan for physicians billing in BC. Here’s an example of a BC medical billing claim:

Pros: You compensated very well for treating patients and you don’t necessarily have to put in an 8-hour day to earn the same amount you would on a full-time salary. There’s also extra incentives when working with complex care patients and when you are called from outside of the hospital to come and care for a patient.

Cons: There’s a bit of a learning curve when it comes to physician billing in BC. You need to make sure you know what fee codes are available to use within your specialty and the rules that apply.

Alternative payment plans (APP)

An Alternative payments plan (APP) is a mutual agreement between you (or group of physicians) and your provincial health authority (MSP). This agreement outlines your salary, incentives, and various after-hour bonuses.

APPs are generally made up of a combination of:

- Fees for clinical services

- Time-based payments

- Rewards for participation in specific clinical initiatives

- Population or capitation funding

- Payment for admin costs

- Bonuses for achieving specific targets

Pros: They are great if you’re working in rural areas where there’s not enough patient inflow, so a normal FFS payment model wouldn’t be realistic.

Cons: They tend to be complicated and you need to make sure everything is clearly outlined in the agreement.

2. Locum Work

If you’re thinking about working as a locum in BC (temporarily covering shifts when another doctor is on holiday, taking a leave of absence, or because a clinic/facility has an overflow of patients), then you’ll most likely be paid under the FFS model. Some places might also give you a guaranteed daily minimum.

Here’s the best benefits of locum work:

- You are a “freelance” doctor and have flexibility and control over your schedule. So you can be as busy or as free as you want to be. If you need 2 weeks off, you just block them off on your calendar!

- Minimal administration – you do not have any of the responsibilities that come with running a practice (hiring/firing MOAs, ordering supplies, etc.).

- It’s a great way to see the country/travel while working.

- It’s a great way to try out a practice before committing to a permanent position.

Like anything, there are downsides, like constantly seeing patients that are unknown to you, which means it takes extra time to familiarize yourself with the patient during a visit. Or having to acquaint yourself with new office staff and new workflows.

If you’re a locum or thinking about locuming then familiarize yourself with the pros and cons, learn how to find a good job and how to negotiate contracts.

3. The Payment Schedule & the General Preamble

If you’re working working FFS or on an alternative payment plan then you need to know what services you’re allowed to submit claims for. Knowing what’s eligible within your speciality is extremely important if you want to maximize you claims and get paid properly for all the work that you do.

The payment schedule is a list of all BC medical billing services that are insured under MSP and how much each service pays. This is where you’ll find descriptions for fee codes and the dollar amount each one pays.

Fair warning, it’s a bit overwhelming since it’s a PDF document around 481 pages long. To try and help clear up how confusing the schedule is, you'll find the general preamble at the beginning. The general preamble provides all the billing rules under which the fees are to be claimed. These rules act as a roadmap to understanding the schedule.

An even easier way to access BC medical billing fee codes and their rules is by using our electronic searchable database. That way you can quickly search by keyword or fee code. Otherwise, billing the correct codes becomes tedious and confusing as it’s almost impossible to search through the PDF on a day-to-day basis.

BC Medical Billing Fee Codes: Searchable Database

4. How BC Medical Billing Payments are Processed

Physicians billing in BC submit claims through the electronic file transmission system ‘Teleplan’. Teleplan is the only way you can submit claims securely in BC.

To submit claims, you also need to use a data centre number. A data centre number tells MSP where the claims are coming from. To get a data centre you need to meet strict legislated privacy and security requirements. Therefore, to submit claims to MSP you need to use a 3rd party billing software system that is equipped to do so.

It is possible to submit claims without a 3rd party software system but only if you bill very low volumes (say, a handful per month). However, most doctors just join an authorized software system in order to upload claims and download reports faster and easier.

Using Teleplan allows:

- Secure user authentication;

- Designation to admin staff or third party agents to submit and reconcile claims on your behalf;

- Electronic reports (Claims Error Reports, Remittance Advice Reports, etc).

Chapter 2 goes over all the registration steps in order to get started with physician billing in BC so that you’re able to submit claims through teleplan.

5. Getting Paid

MSP processes claim submissions in batches of 2 each month. All claims submitted before 11am on deadline dates will be on your next remittance. *Anything past 11am will be processed in the next cycle.*

Example:

Imagine today is January 19th and it’s the deadline to submit your claims. You were last paid on the 13th, and the previous deadline was January 3rd.

All claims that you’ve submitted since the 3rd (up until 11am today) will be processed for this cycle. Use this downloadable calendar to make sure you never miss a deadline and get paid on time.

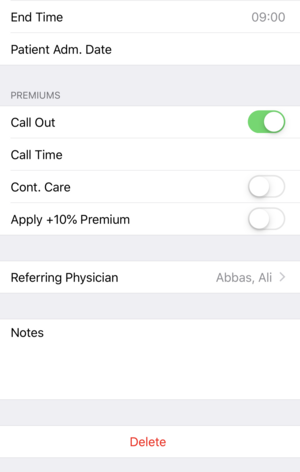

6. MSP Remittance Advice (RA) Report

Typically 7-10 days after you submit your claims you’ll get a ‘MSP Remittance Advice (RA) Report’ and an ‘Error Code Report.’ These reports let you know, in detail, which claims have been approved, paid with adjustment, rejected or have errors that require specific changes in order to be paid.

Your MSP Remittance Advice (RA) Report is provided through your billing program. They will automatically download the report and display it in an easy-to-read format. For example, if you’re billing with Dr. Bill then your MSP Remittance Advice (RA) Report would be emailed out twice monthly. You can also subscribe to get daily reports that show you how much you’ve claimed each day.

MSP Remittance Advice (RA) Report – Payment Breakdown

If you’re billing through Dr. Bill you’ll have the option to see the current status of all your active claims at any given time. You can:

- Easily see the status of each claim

- See a list of refusals

- See a list of rejected claims

- See which claims have been paid/paid with adjustment

7. Claims Error Report

Sometimes, you MSP claims may be rejected, reduced or refused. This can happen for a variety of different reasons (around 706 different reasons, to be exact)!

When you do get an error, it will be accompanied by a code, and a description explaining what that code means. Use our searchable database to find out the description of your explanatory code:

Explanatory Code Lookup

8. Overage Claims

All claims are required to be submitted to MSP within 90 days of the original date of service. If you submit anything beyond this deadline, it will be refused with a BV explanatory code.

You can try and attempt to have overage claims paid, but keep in mind that MSP requires a valid reason for the delay.

If you would like us to recover these funds for you, please notify us of your reason for the delay. We charge $75 per claim form to recover them on your behalf. While MSP is reluctant at times to pay these funds we have a very high success rate and actively pursue all funds which you should otherwise be entitled to.

In general though, it’s best to try and remember to submit your claims within 90 days to avoid penalties.